Real estate funds for asset managers

Your real estate funds –

from fund launch

to administration

You take care of your real estate, we take care of all fund services

Universal Investment is a strategic partner and fund service platform for fund promoters and asset managers. With many years of experience for real estate, the Real Estate Team successfully structures and administers real estate investments in Germany and Luxembourg.

As a fund initiator and specialist in real estate transactions and management, you concentrate on your core tasks. We take care of the fund administration.

Advantages

Structuring and administration from one source

Transparency

Flexibility

Regulatory

Focus

Real estate in numbers

34.4

>1.650

54

>55

As of September 2023

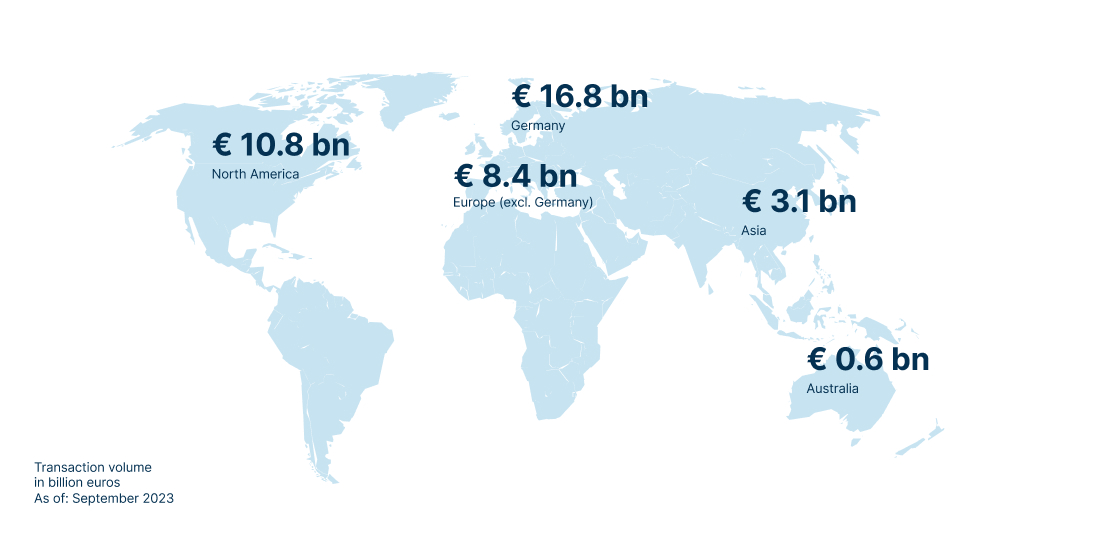

Global real estate competence

Universal Investment supports fund promoter and asset managers with global real estate competence in implementing investment strategies by active monitoring and reviewing of transactions on all markets.

Source: Universal Investment

Source: Universal Investment

Real estate platform

Since the launch of the real estate platform in 2011, outstanding growth has been achieved with an increase in assets under administration (AuA) exceeding 34.4 billion euros. This success story reflects the high level of our client confidence in the quality of services (as of September 2023).

Contact

New customers

Marcus Kuntz

Area Head Sales & Fund DistributionExisting customers