Service Range for Institutional Investors

Transparent

Reliable

Consistent

Customised Solutions for all Asset Classes

Every institutional investor is faced with individual challenges that in turn require an individual approach. Our experts understand the demands of your industry and can identify the right solutions – unbiased and with foresight.

What sets us apart is our innovative drive, our extensive expertise in setting up and implementing customised structures and our skillful navigation keeping regulatory requirements in mind.

From securities to alternative investments, from real estate to digital assets.

Universal Investment covers the entire spectrum of relevant legal wrappers and vehicles and is active in the fund domiciles of Germany, Luxembourg and Ireland.

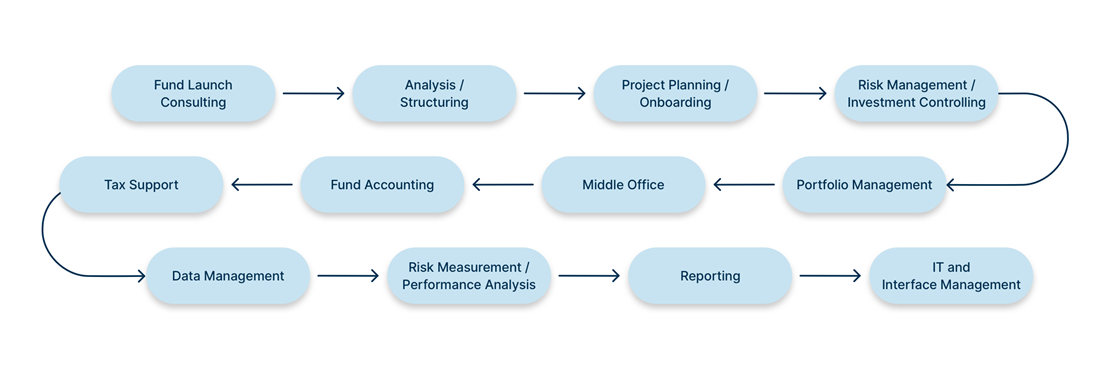

We support you along the entire value chain or, if required, only in specific modules. Your personal relationship manager, with you from the very start. Improving business together.

Understanding the challenges, you face

We understand the specific demands of our times as well as the challenges these pose for institutional investors. Data- and cyber security is one example. We handle our investors’ data with the utmost care and consistency: our data servers are based in Germany and are hosted by our subsidiary

UI Information Technologies. Sustainability is equally important to us: we are committed to sustainability at our company and in the services that we provide to our investors. Our comprehensive ESG reporting sets reliable standards.

We understand the investment market and draw on our expertise to drive innovation in areas such as the Master Fund 2.0 and UI Enlyte platform for regulatory-compliant access to digital assets. With the help of solutions like the master KVG, we ensure optimal investment management as well as comprehensive, transparent reporting and risk management. Services such as portfolio management and the subsectors of overlay, transition management and collateral pool management complement the product range.

As one of Europe’s leading fund service platforms and Super ManCos, we have been supporting institutional investors for more than 50 years. Developing customised solutions for the launch and administration of a wide range of asset vehicles for our clients is our driving force.

Focused and with foresight

Rule-based portfolio management with overlay management and reporting across all asset classes and vehicles as well as ESG reporting ensure that portfolios are focused, comply with regulatory requirements as well as balance risks and opportunities.

-

Staying on Track

Overlay Management -

Reporting

Reportings at a glance

Contact

Marcus Kuntz

Area Head Sales & Fund Distribution