Press Release

Real Estate Survey 2024: Investors look to reallocate - North America and Asia, along with Residential and Logistics, gaining ground

Date:

01. October 2024

Frankfurt / Main

- Investments in North America continue to be a focus alongside Asia.

- Residential and logistics complement office space as the most important property types.

- Falling interest rates are the main driver behind the revitalisation of transaction markets.

- Open-ended alternative investment funds are the most popular investment vehicles for new fund launches.

Germany remains in focus, North America and Asia increasingly represented in portfolios

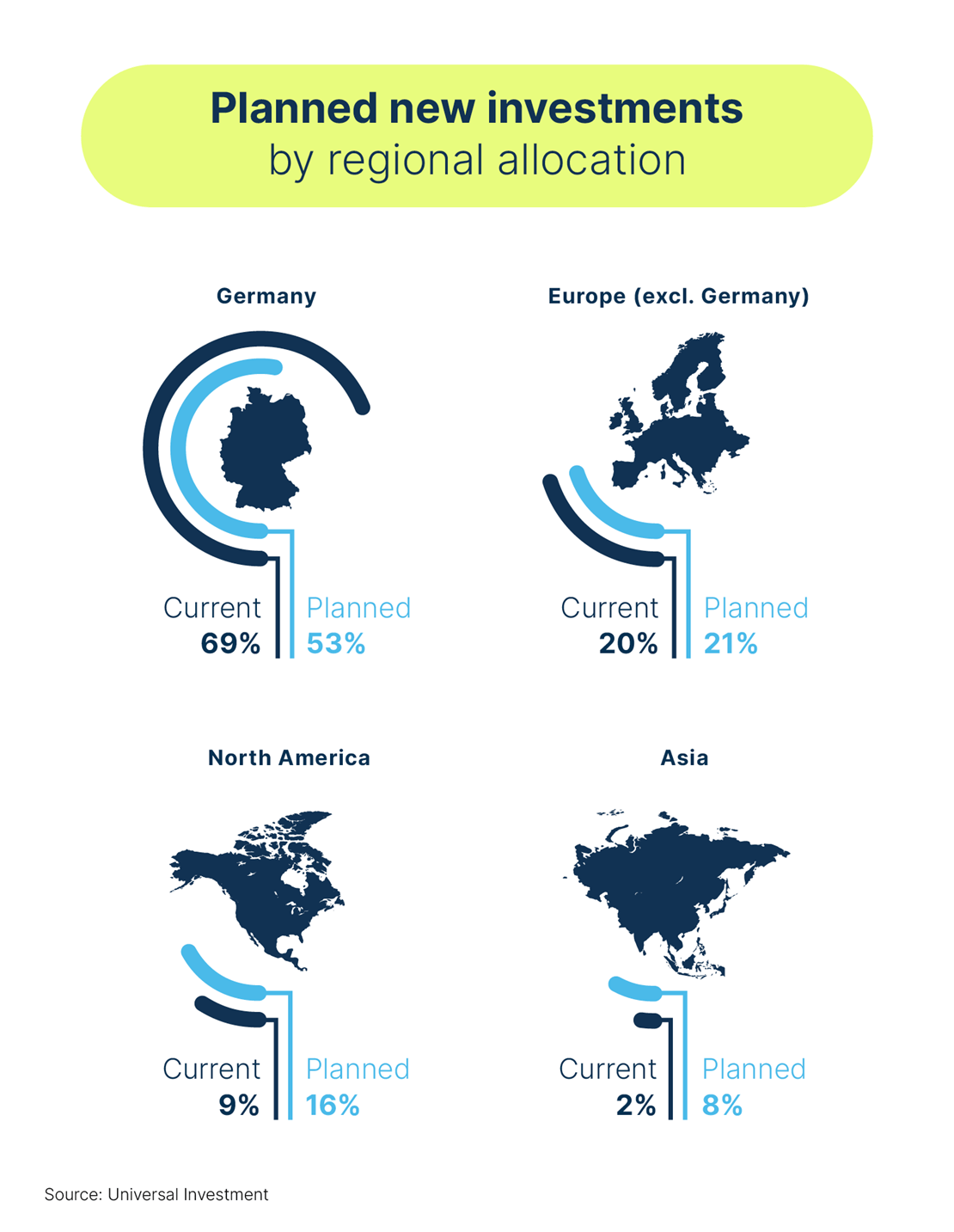

The portfolios of the participating institutional investors show a strong home bias: On average, 69% of their real estate is in Germany, 20% in other European countries, and 9% in North America. For those holding properties in the Asia-Pacific region, these account for around 2% of their total real estate investments. As in previous years, emerging markets play almost no role for the survey participants.

Comparing the current figures with the projected allocations for 2024 from last year’s survey, only one target allocation was achieved, while three were missed. The share of German real estate was expected to fall to 57%, but this goal was far from achieved. Allocations in Europe, excluding Germany, fared better, with 20% achieved versus a forecast of 26%. Meanwhile, Asia-Pacific allocations fell well short of the target of 8%, achieving just over 2%. Allocations in North America, however, hit their target of 9% for this year.

This is not expected to remain the case. Significant shifts are anticipated for new investments over the next 12 months. While the share of German real estate is expected to decrease to around 50%, the survey participants plan to increase their allocations in all other markets, in some cases drastically. The Asia-Pacific region has now become a top priority: future allocations in the region are expected to nearly quadruple to over 8%, while North American (16%) and other European (21%) allocations are also expected to rise sharply.

"In the current market phase, real estate is and will remain an indispensable component of institutional portfolios. Despite changes in the interest rate environment, most investors plan to keep their current real estate allocation of around 25%," explains Markus Kuntz, Group Head of Sales at Universal Investment. "However, this does not mean that they are not considering or making new allocations. The Asia-Pacific region, in particular, offers significant potential and many investment opportunities. Interest in residential real estate continues to grow as well. Due to rising rents and their stability, residential real estate provides investors with secure, long-term returns."

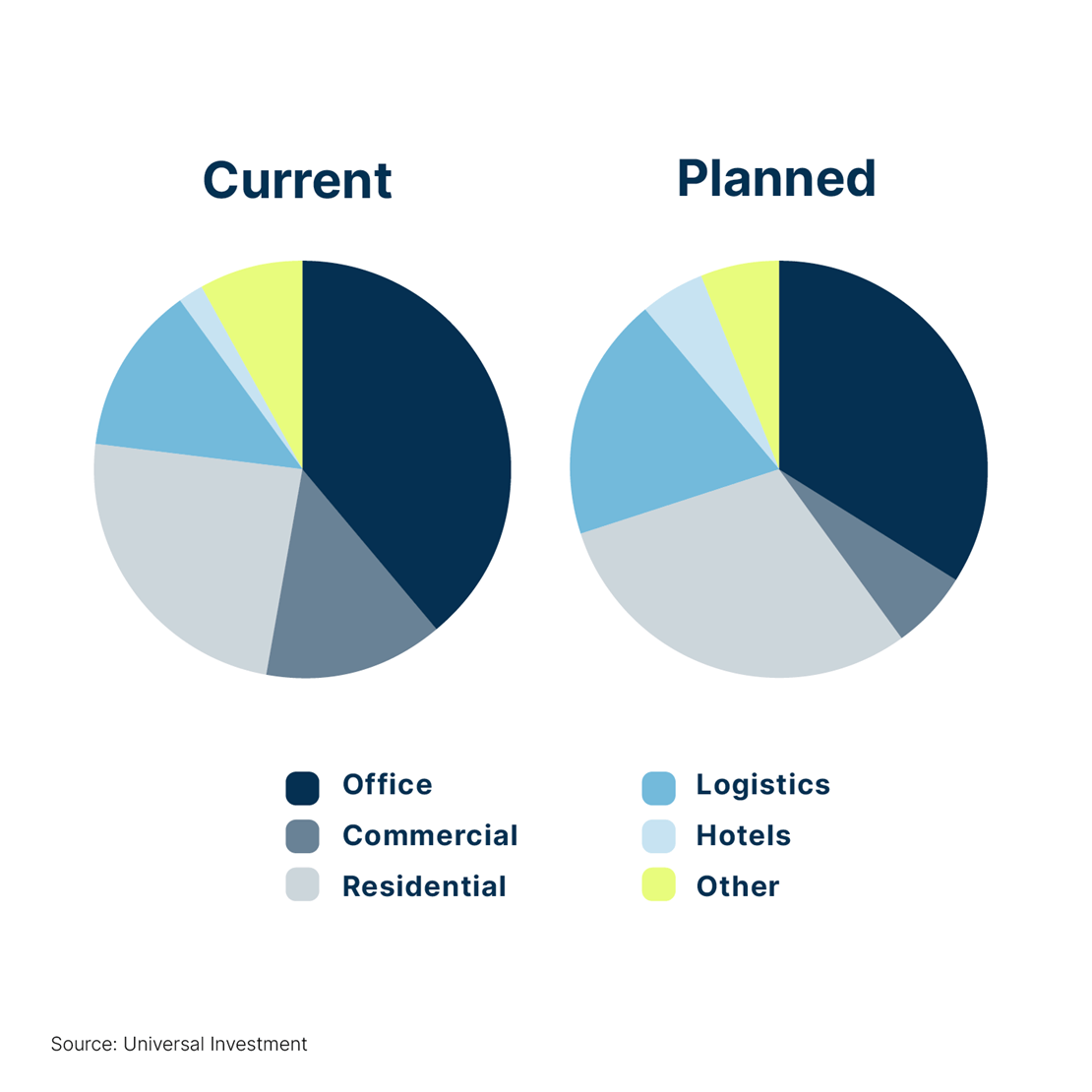

Residential and logistics complement offices as the main property types

In terms of sectoral allocation, offices remain the most dominant, with an average share of 39%, though this is slightly down from 40% last year. In contrast, residential properties have increased to an average of 24% (up from 16% the previous year), while logistics remained unchanged at 13%. The same trend is expected for new investments over the next 12 months, with the share of residential (30%) and logistics (19%) set to increase, bringing residential properties almost on par with offices (34%). According to the survey, hotels are also becoming more important (around 5%), while segments such as medical centres and retail.

Many of the participating institutional investors are increasingly focusing on residential properties. For new investments, they mainly prefer traditional apartment buildings in full ownership (59%), micro-apartments (40%), and student flats (37%). In contrast, the survey participants have little to no interest in traditional apartment buildings in partial ownership, co-living spaces, or social housing. Converting commercial properties into residential ones is not an option for four-fifths of the respondents.

Real estate prices are acceptable and stable

The majority of respondents consider real estate prices for new investments across all property types to be high but still acceptable or fairly priced. In Germany, 76% of respondents share this view (compared to 67% last year), while 83% feel this way about the rest of Europe (down from 94%), and 94% about the rest of the world (up from 88%). In Germany, 18% of respondents find the prices no longer acceptable, compared to 28% last year. Overall, the majority of survey participants (59%) expect real estate prices to remain unchanged over the next year.

Following the first interest rate cuts, 56% of participants are confident that the transaction markets will see a revival in 2025. Many see further interest rate reductions, which bring buyers and sellers closer together, as the main factor driving this resurgence (50%), far ahead of distressed sales due to insolvencies and non-performing loans (19%).

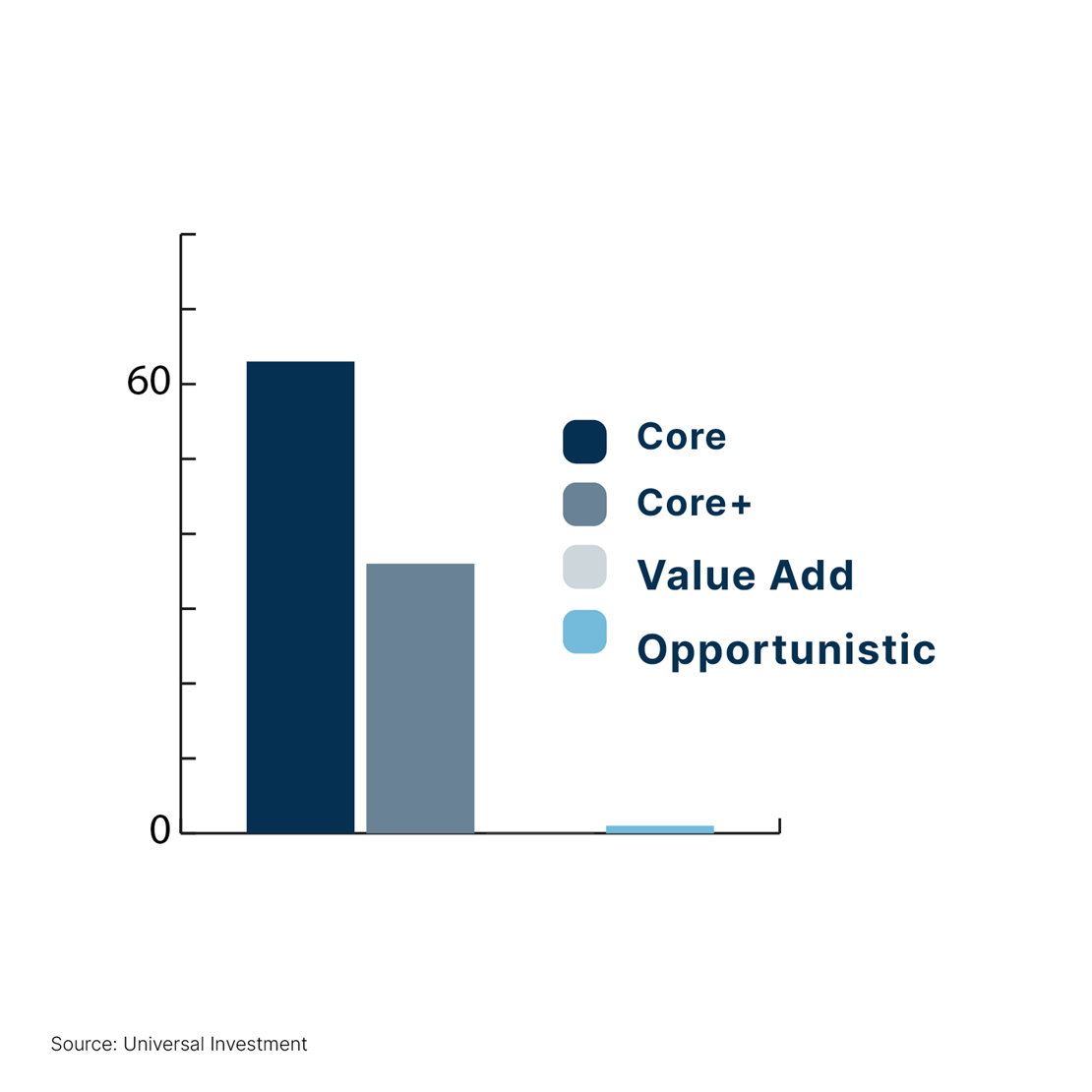

Focus on cash flow, core investments remain dominant

Institutional investors generally expect a 4% annual cash flow yield for new investments, a slight decrease from 4.1% last year. In Germany’s top 7 cities, 41% of investors expect net initial yields of 3.0 to 3.5% by 2025, while 35% expect net initial yields of over 4.0%. In terms of risk class, participants continue to play it safe: core investments remain the most popular at 64% (up from 60% last year), followed by Core+ at 44% (up from 29%).Diversifying beyond real estate: interest in alternatives and liquid assets

The current real estate allocation of the survey participants averages 25% and is expected to remain unchanged. Half of the institutional investors considering reducing their real estate allocation plan to reinvest in alternative investments, such as infrastructure or private equity. 38% would shift the capital into liquid assets, while the rest would increase their liquidity buffer.

"The real estate market is showing signs of stabilisation, driven by the long-term investment horizon of German institutional investors and the potential for increased transactions due to falling interest rates. While traditional investment vehicles, such as German open-ended real estate AIFs under the trust model, remain popular, we are also seeing growing interest in co-ownership funds, where investors can contribute their direct real estate holdings to an open-ended real estate AIF while retaining ownership and possibly without incurring real estate transfer tax," says Jochen Meyers, Group Head of Relationship Management at Universal Investment

Media contact

Bernd Obergfell

Head of External Communications